The Indonesian regulations seemed straightforward until we dug deeper. A Fortune Global 500 client was planning their market entry strategies, confident they had ticked all the regulatory compliance boxes. However, the reality on the ground was far more complex. The official pharma regulation stated one thing, but the unwritten rules of implementation at the National […]

Considering business operations in Myanmar? As an FDI specialist, I guide businesses through complex environments. Let's understand the company registration in myanmar process together!

Key Takeaways:

- Myanmar’s changing landscape needs to be understood.

- Choosing the right company structure is key to your goals.

- A clear process is efficient.

- Awareness of compliance avoids pitfalls.

- Expert guidance is essential for navigating and long term success.

Read More: FDI in Vietnam: A Transformation from Isolation to Global Engagement

Understand Myanmar

For foreign investors: regulatory context

Myanmar presents a distinct landscape for foreign investors, underpinned by the Myanmar Foreign Investment Law (MFIL) and the Myanmar Companies Law (MCL) 2017. These laws provide a clear pathway for establishing diverse investment structures, including the significant advantage of up to 100% foreign ownership in numerous sectors, as per ASEAN Briefing's 2022 guide on corporate establishment.

While the period since February 2021 has undeniably introduced complexities to the investment environment, a nuanced understanding of the existing regulatory framework is key to unlocking potential - not only the country's strategic location as a gateway to China and India but especially in the Manufacturing and Services sector. Foreign investors can still actively pursue and benefit from MFIL registration, which offers valuable incentives and potential tax advantages. The Directorate of Investment and Company Administration (DICA) remains a vital contact for streamlined company registration, and the Myanmar Investment Commission (MIC) continues to facilitate approvals for larger investments.

For locals: evolving reforms

The MCL 2017 has modernized the previous company law framework, as explained by Latt Latt Soe Thiri in a 2017 ResearchGate publication. MCL allows foreign investors to hold up to 35% stake in local companies without changing their status as a Myanmar company, which was intended to facilitate foreign investment. While government incentives for Small and Medium Enterprises (SMEs) exist, bureaucracy remains a significant hurdle.

Why Structure Matters

Choosing the right entity

You have Private Limited, Public Limited, Branch or Representative Office. Choosing the right business structure that aligns with your business goals and legal requirements is key. Each has different taxation implications. Plan your profit repatriation early. Your chosen structure must align with your strategic goals, a key consideration also mentioned in Emerhub’s Myanmar company registration guide.

Cross-border founders

Clear shareholding terms are essential. Setting up a legal entity in Myanmar involves many challenges and risks, including potentially lengthy and costly requirements. The MCL generally requires at least one resident director. Historically, and where applicable, Private Limited companies have been a popular choice for new registrations.

Key Legal Enablers: Decoding the Myanmar Companies Law 2017

Registering your company in Myanmar allows businesses to operate legally under the MCL 2017. This legal framework outlines the process for company formation and provides for the protection of local and foreign shareholders' rights, though the practical enforcement and stability of this protection are subject to the prevailing political and economic conditions. While the country possesses long-term potential due to its large and young population, and the government has previously introduced incentives such as tax holidays, it is imperative for potential investors to conduct thorough due diligence and assess the significant risks associated with the current volatile environment before committing to business expansion or investment.

Leveraging Technology: MyCO – Your Portal for Modern Company Administration

Registering your company in Myanmar is a must for businesses looking to set up in the country. The process involves registering with DICA under the MCL 2017. This law provides a framework for company registration, including requirements for local and foreign shareholders, company name, registration number and registered office address. With Myanmar Companies Online (MyCO), the process has become more streamlined and easy. You can now register and access company documents and extracts online, reducing the administrative burden and ensuring compliance with the law. This modernization through MyCO empowers companies to navigate the initial setup with greater ease, providing a solid foundation even as the broader investment environment requires careful consideration.

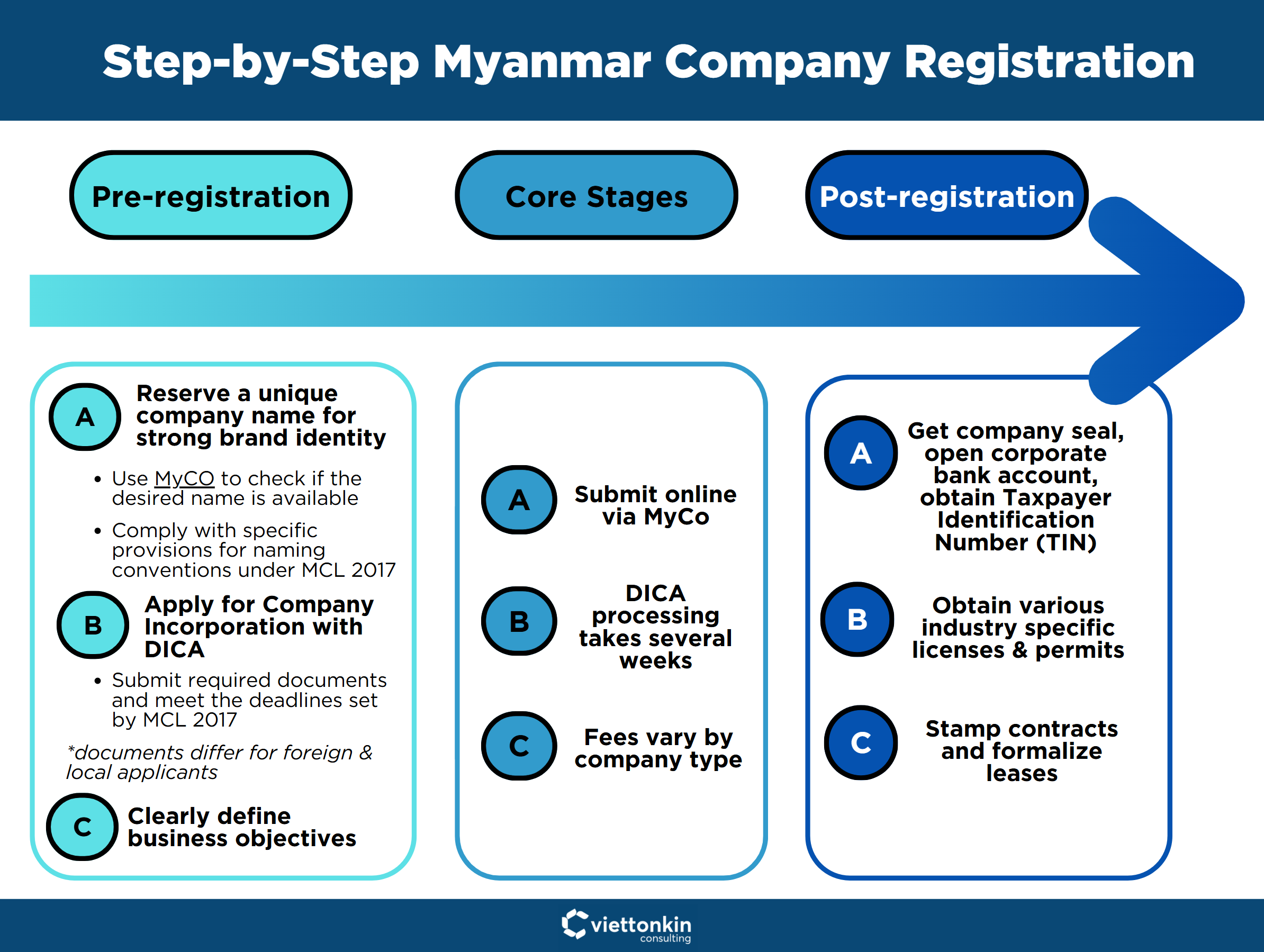

Step-by-Step Myanmar Company Registration

Company Registration Requirements

| Requirement #1: The company must have a unique name. | ✅ Approved by DICA.*This is crucial to avoid conflicts and establish market presence |

| Requirement #2: The company must have a registered office address in Myanmar. | ✅ For official correspondence and legal notices.✅ Submit various documents, (including the Memorandum and Articles of Association) to DICA, outlining the company’s structure, objectives, and operational guidelines. |

| Requirement #3: A private company must have at least one director who is ordinarily resident in Myanmar. | ✅ Local point of contact for regulatory and administrative purposes.✅ Register with MyCO |

| Requirement #4: Foreign investors can own up to 35% of a local company without changing its status as a Myanmar entity. | *Any changes to the company’s structure or ownership must be notified to DICA to maintain compliance with the law. |

By meeting these requirements, businesses complete the legal registration process, though success in operations remains heavily dependent on navigating the complex and challenging business environment.

Company Registration Fees and Costs

Fees and costs for registering a company in Myanmar vary depending on the type of company and services required. For a private company, the registration fee is MMK 250,000 (approximately USD 180). For a public company, it’s MMK 500,000 (approximately USD 360). These fees cover the basic registration with DICA. Besides the registration fees, there are other costs to consider. These include the cost of industry specific licenses and permits which are required for legal compliance and operational authorization. Companies also need to register for tax and get a Taxpayer Identification Number (TIN) which involves additional costs.

For foreign investors, the cost of business visa is another consideration. The total cost of registering a company in Myanmar can range from MMK 500,000 to MMK 2,000,000 (approximately USD 360 to USD 1,440) or more depending on the complexity of the registration process and the business requirements.

Given the many costs involved, it is highly recommended to seek the advice of a legal professional. Legal experts can guide you on how to meet all requirements efficiently and navigate the registration process to ensure all necessary steps are completed correctly and on time.

Registration Timeline and Processing Time

The registration timeline for a company in Myanmar varies depending on the type of company and the complexity of the registration process. For a private company, the administrative processing time by DICA via MyCO is typically around 1-2 weeks once all correct documentation is submitted. For a public company, this process usually takes longer, around 4-6 weeks, due to their more complex structure and often larger capital investment.

The registration process involves submitting applications through the MyCO system, which allows for efficient submission and tracking. Once DICA approves the application, companies then proceed to register for tax and obtain a TIN.

While MyCO has streamlined the administrative registration process, companies must still comply with all relevant laws and regulations, including the MCL 2017 and MFIL. However, it's important to note that despite administrative efficiencies, external factors related to the current political and economic situation may still impact the overall time and ease of starting operations.

Business Location and Registration

Business location is a key consideration when registering a company in Myanmar. The registered office address must be within the country and businesses can choose from various locations including Yangon, Mandalay and Naypyidaw. DICA has offices in these locations making it easier for businesses to register and access company documents. By choosing a strategic business location, companies can leverage local resources, infrastructure and talent. This decision can impact operational efficiency and market reach of the business making it a critical consideration during the registration process.

Limited Liability and Protection

One of the main benefits of registering a company in Myanmar is the limited liability protection it offers under the law. MCL 2017 states that the liability of shareholders is limited to the amount of their share capital, thus protecting their personal assets in case the company incurs debts or liabilities. This applies to local and foreign shareholders, providing a foundational legal safeguard for their investments. However, the practical extent of this protection may be impacted by broader political and economic instability. DICA also provides comprehensive guidance on company administration, including requirements for holding annual general meetings, filing annual returns, and notifying company structure changes. Compliance with these requirements ensures businesses remain compliant with local laws and regulations within the existing operational framework.

Compliance Pitfalls

Annual filings

ARs and financial statements must be filed with DICA. Technology integration in delivering legal services means efficiency and cost effectiveness. Late submission penalties apply. Audit requirements trigger for larger entities.

Foreign entity taxation

Key taxes are corporate income tax and commercial tax. While tax incentives are available for foreign entities under the Myanmar Investment Commission (MIC), it's important to consider that the prevailing political and economic risks significantly outweigh these incentives for many potential substantial investments. Double Taxation Agreements (DTAs) can provide relief on withholding taxes. Commercial Tax applies to goods and services.

SME mistakes

Common errors include not updating DICA information timely, misclassifying business activities or overlooking labor compliance. For various types of companies, it is important to understand financial requirements including foreign companies need to submit minimum capital in installments. Regular internal reviews are the fix.

Strategic Long-Term Success

Scaling: governance

Set up a solid board structure from the beginning. Paid up capital is important for operational needs, as advised by consulting firms like FocusCore. Use robust shareholder agreements, especially important in Myanmar. Plan for conflict resolution, often via arbitration. My extensive ASEAN experience underscores these governance foundations.

Market-readiness

Focus on localizing your branding and digital strategy. Effective Human Resources for local hiring, payroll and retention is key. Protect your Intellectual Property through local registration. Understand the difference between general trade license and industry specific special permits.

Business Association and Networking

While registering a company in Myanmar provides a formal entry point into the market, the landscape of business associations and networking opportunities has significantly shifted since 2021. MIC and DICA remain the official government bodies for investment and company administration, providing guidance and resources as per their mandates.

Joining business associations and chambers of commerce can offer networking, though the scope and effectiveness are impacted by the current environment. The Union of Myanmar Federation of Chambers of Commerce and Industry (UMFCCI) is the main business association representing the private sector in Myanmar.

Industry-specific associations also exist to provide sector-specific information. Engaging with these entities can still provide connections and insights, but businesses must manage expectations regarding the current operational environment and the limited advocacy for a 'business-friendly environment' given the ongoing crisis. Leveraging these resources can help businesses navigate local business opportunities and mitigate risks.

Expert Myanmar Setup Support

Why local guidance is vital

Navigating local legal nuances and language barriers is smoother with local guidance. Registering an overseas corporation in Myanmar involves understanding the different company formats permitted under Myanmar Companies Law and the conditions under which foreign entities must register, especially if they intend to do business in Myanmar. Effective liaison with DICA, MIC, and banks is crucial. This approach helps in understanding and mitigating the inherent risks in the current market.

Viettonkin’s edge

While Myanmar holds long-term potential, success in the current climate depends heavily on realistic risk assessment, smart structuring, and diligent compliance. With us at Viettonkin, your business gets support to navigate the complexities and challenges of the Myanmar market. Thorough due diligence and a cautious approach are paramount for any investment decision.

As your partner, we offer setup, company secretarial, and ongoing compliance services. You get our ASEAN-wide practice expertise built on over 2,000 projects across APAC. The company registration procedures through the Myanmar Companies Online platform are administratively streamlined, outlining the types of companies that can be registered and the requirements for foreign ownership and director residency. Contact us now for a consultation!